Rental Market Analysis for Landlords Forecasts Bright Economic Outlook Through Second Quarter in New Info-graphic

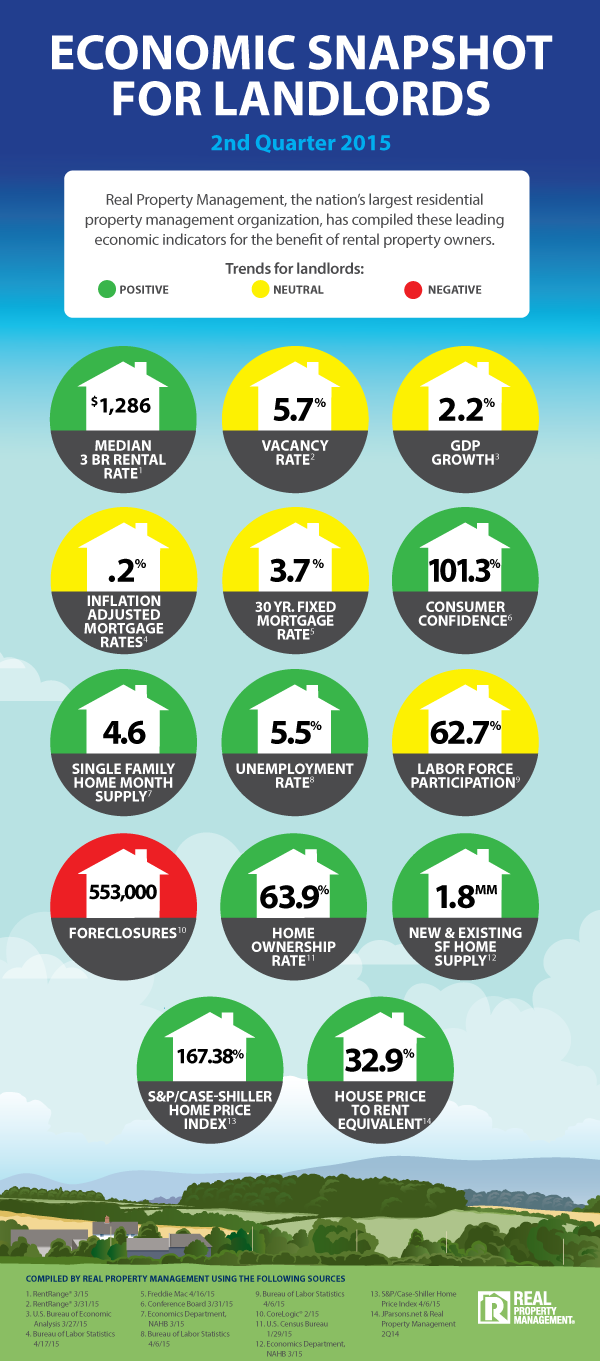

Real Property Management, the nation’s leading property management company, forecasts landlords should expect a positive rental market through the second quarter. The projection is based on the company’s “Economic Snapshot for Landlords,” an info-graphic analysis of 14 key economic factors known to impact the rental market.

Key trends from the snapshot that suggest a positive economic outlook for rental property investors through the second quarter include:

- Already-Tight Rental Markets to Get Tighter – Vacancy rates have steadily declined from a peak 10.7 percent rate in 2009 to the current 5.7 percent rate1. Real Property Management expects a continued decline in rental vacancies in the coming months as the job market improves, homeownership declines, and Millennials begin to move out of their parents’ homes and into their own households, which will likely be rentals.

- Americans Continue to Shift toward Renting – From its peak rate of 68.6 percent in 2003, homeownership has steadily fallen to its current 63.9 percent rate2 – the lowest level in more than 20 years. During the past year alone, the rate dropped a full percentage. Any potential increases in homeownership related to low mortgage rates have been offset by higher house prices and continued economic uncertainty.

- Improving Job Market Bodes Well for Household Formation – The unemployment rate has steadily declined to 5.5 percent in March3, significantly lower than 2009’s peak rate of 10 percent. Even though labor force participation continues to lag, a stronger job market enables more Americans to start their own households, which will likely lead to an increased demand for rentals.

Rental Rates to Continue Rise – In the months ahead, Real Property Management projects that rental rates will rise. The reasons include recent declines in vacancy rates, reductions in the single-family home month supply, gains in the employment rate, as well as continued declines in home ownership and supply of new and existing single-family homes. Although most indicators point to a positive or neutral road ahead, Real Property Management cautions that landlords may have fewer investment opportunities in the second quarter – especially at distressed levels – as the number of foreclosures continues to drop. In February, CoreLogic® reported 553,000 foreclosures compared to 761,000 a year earlier4.

Although most indicators point to a positive or neutral road ahead, Real Property Management cautions that landlords may have fewer investment opportunities in the second quarter – especially at distressed levels – as the number of foreclosures continues to drop. In February, CoreLogic® reported 553,000 foreclosures compared to 761,000 a year earlier4.

“There seems to be a dearth of available information about the state of the rental housing industry – especially for landlords – and we’re endeavoring to change that with quarterly rental market snapshots,” said Don Lawby, President of Property Management Business Solutions, the franchisor of Real Property Management. “Through the second quarter, our outlook for landlords looks very positive.”

Real Property Management is the leading property management franchise in the nation with more than 260 offices in 44 states. The company specializes in managing single-family homes, townhomes, condos, multiplexes and small apartment buildings. Its services include finding and screening tenants, completing the lease agreements, collecting rent, maintaining the building and grounds, arranging for any necessary repairs on a 24-hour basis, and processing evictions when necessary. Real Property Management also manages the legal compliance for both state and federal real estate law.

Sources: 1. Proprietary vacancy rate data provided by RentRange©; 2. U.S. Census Bureau: Residential Vacancies and Homeownership in the Fourth Quarter 2014; 3. U.S. Census Bureau of Labor Statistics, April 17, 2015; 4. CoreLogic®, February 2015.

We are pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the Nation. See Equal Housing Opportunity Statement for more information.